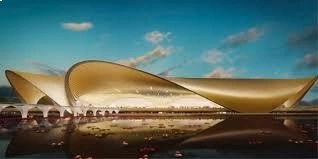

India Set to Become Fastest Growing Major Aviation Market by 2026

India is poised to become the world’s fastest growing large aviation market by 2026, according to Airports Council International (ACI). While China leads in overall aviation market size, India’s growth is accelerating thanks to rising demand for air travel…